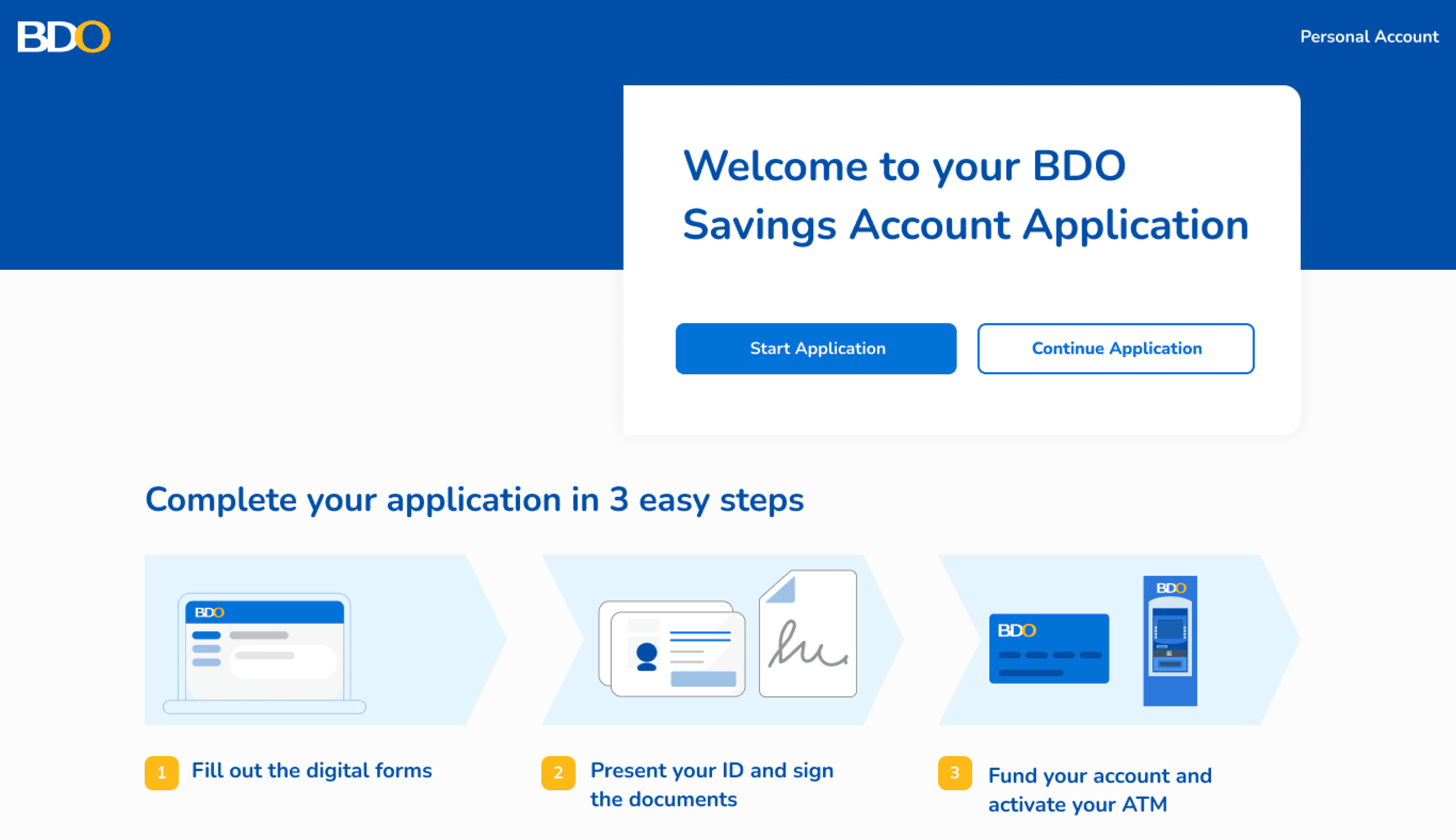

Digitizing onboarding of Current and Savings Account of BDO Bank Philippines

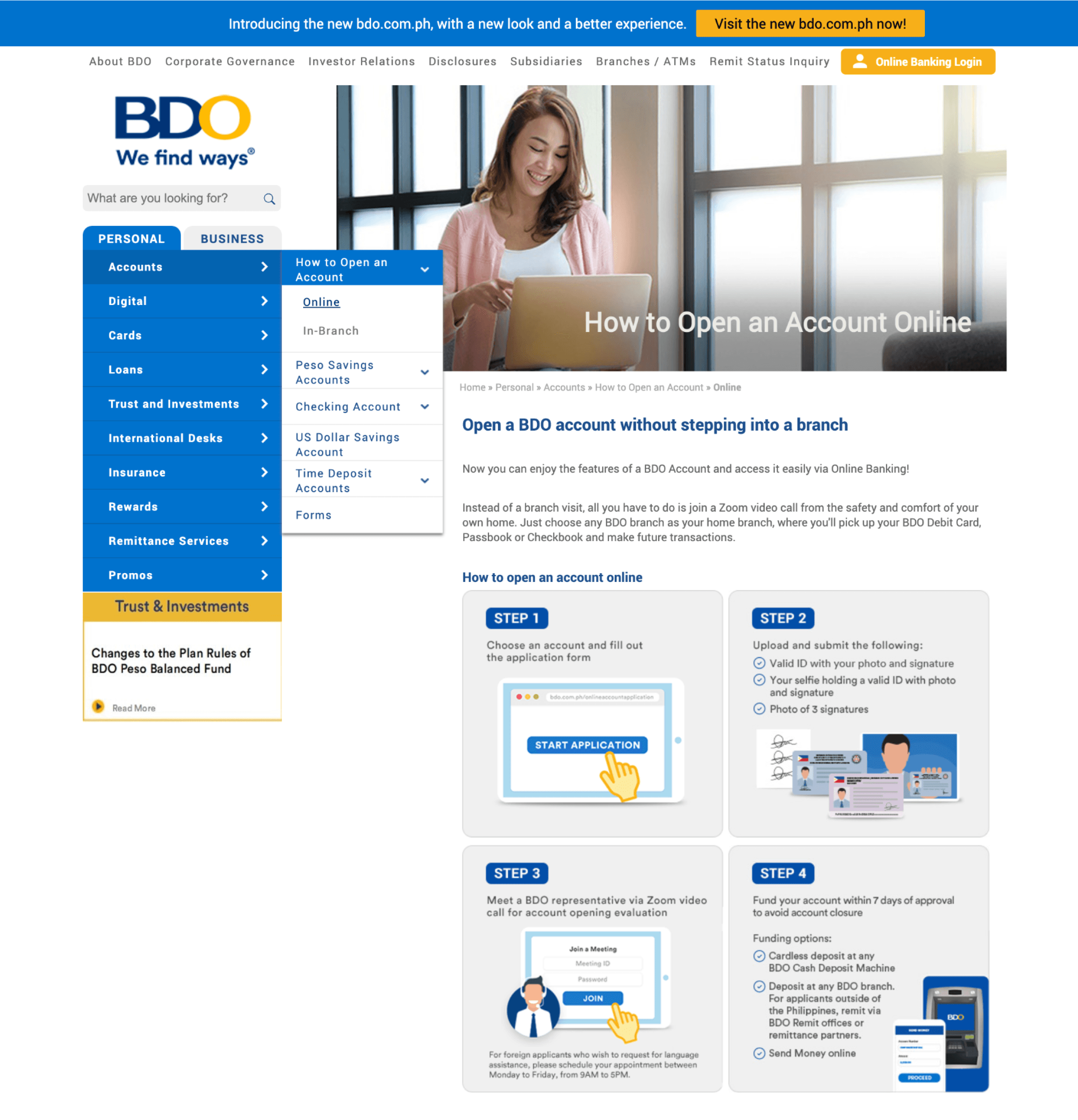

This project focused on digitizing the account opening process for BDO Bank Philippines. The goal was to create a new online experience for onboarding both Existing To Bank (ETB) and New To Bank (NTB) customers, along with a new in-branch onboarding process for tablets.

UX Designer

As the sole designer on this 4-month project, I conducted comprehensive research, created wireframes and prototypes, and designed the user interface. My responsibilities spanned the entire UX/UI workflow, from user needs analysis to delivering a polished, user-centric solution through close collaboration with all the stake holders.

Project Overview

During the COVID-19 pandemic, the need for a digital account opening process became increasingly important. BDO Bank sought to create a new online experience to improve customer onboarding for both ETB (existing customers) and NTB (new customers). Additionally, they wanted to develop a new tablet-based onboarding process for in-branch customers.

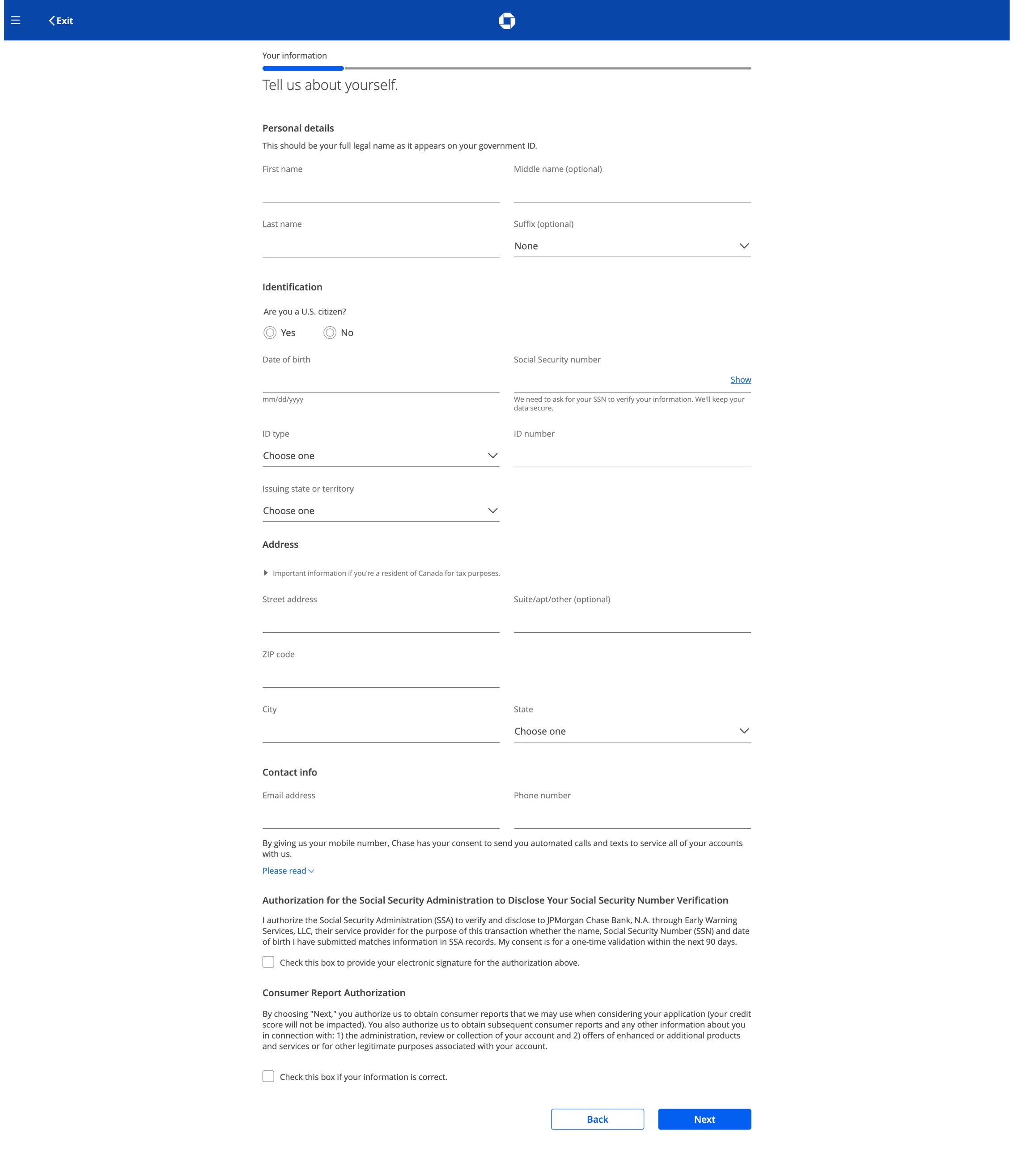

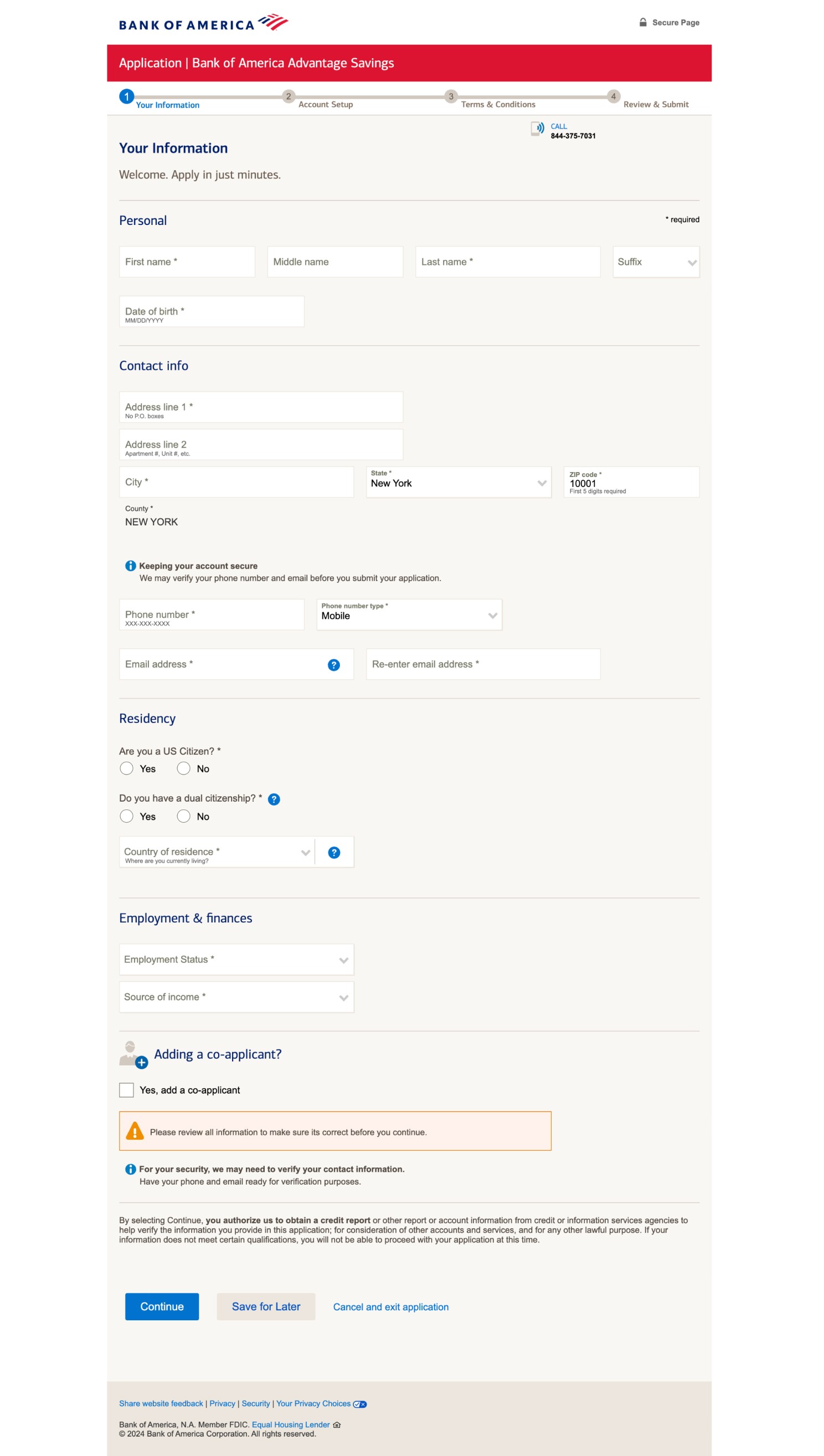

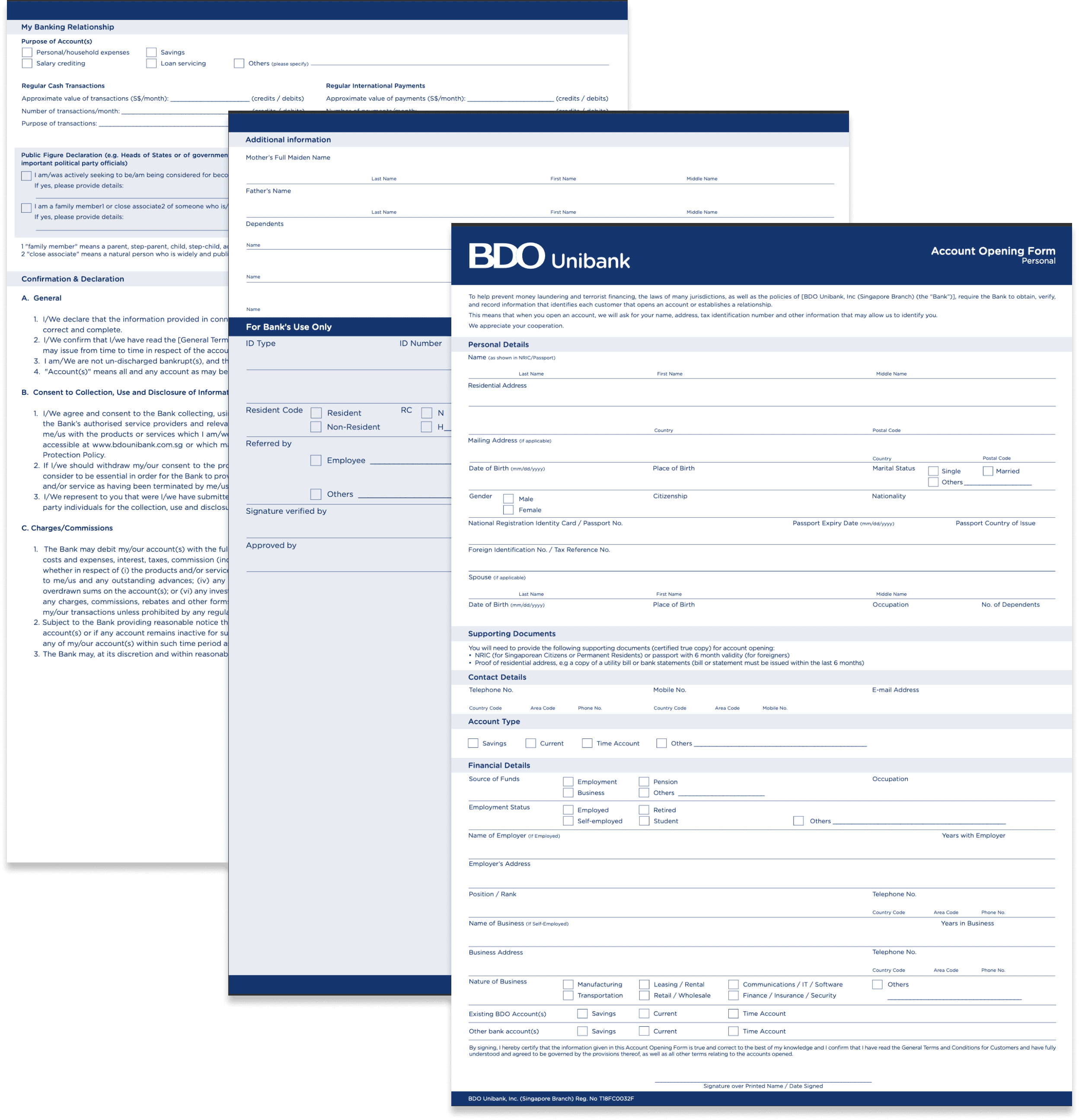

Competitive Benchmarking

We evaluated the online account opening processes of Bank of America and Chase Bank, focusing on aspects like form design, information hierarchy, error handling, and mobile responsiveness. This analysis provided valuable insights to improve BDO's onboarding experience.

Understanding Requirements

Stakeholders at BDO Bank, including:

1) Consumer Business Head

2) Compliance Team

3) Legal Team

4) Technology Team

Key considerations for design included:

1) Smooth information flow throughout the onboarding process

2) Easy document submission for customers

3) Opportunity for add-on product sales during onboarding

4) Strict adherence to government compliance regulations

Finalising the Customer Onboarding Flow

The project meticulously designed the customer onboarding flow, encompassing the following stages:

1) Customer Information Collection

a) Personal Information

b) Financial Information

c) Account Details

d) Regulatory Information

2) Document Submission

3) Summary with details of the new bank account and customer information

4) Online Activation of account, web and mobile banking access

5) Additional product sales opportunity

Design Considerations

Careful consideration was given to the design to ensure a positive user experience:

Tailored Experiences

Unique onboarding experiences were created for ETB, NTB, and in-branch customers.

Responsive Design

The onboarding process was designed to be fully responsive across all three screen sizes (mobile, tablet, and web) for each customer type (ETB, NTB, in-branch).

Clear Information Grouping

Information was grouped and presented clearly using the Hershey Method for optimal readability.

Transparency and Trust

Additional information was provided at key steps to build trust and transparency with the customer.

Seamless Uploads and Verification

Easy upload of documents with a smooth verification process was ensured.

Editable Information

Customers were empowered to easily edit any information they entered during the onboarding process.

Step-by-Step Guidance

Clear indications were provided at each step to inform customers of what to expect next.

Impact After Launch

Launched in February 2021, the project has resulted in significant improvements for BDO Bank:

Enhanced Customer Onboarding Experience

The new onboarding process provides a more streamlined and efficient experience for customers.

Industry First in the Philippines

BDO Bank became the first bank in the Philippines to offer a fully digital customer onboarding experience.

Snehalkumar Shinde

Digital Designer

Connect with me

snehal1155@gmail.com

+918971577976

Thank you for the visit!