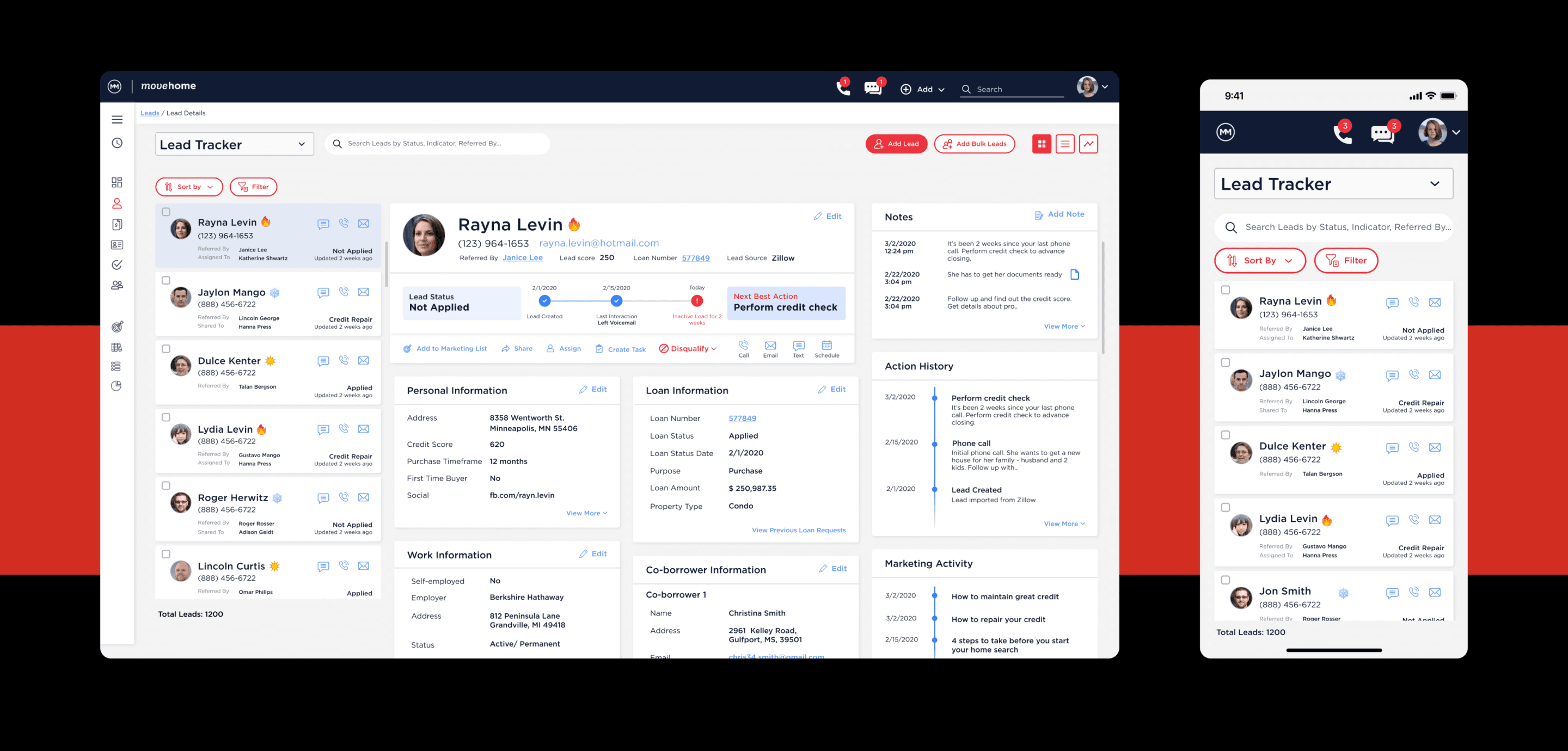

Boost Lead Conversion Through Thoughtful Interactions

This CRM application empowers Loan Officers (LOs) to nurture leads more effectively. It provides improved visibility into lead data and suggests actions to keep them engaged throughout the loan application process.

Offshore Design Lead

I worked in a 4 member team. I personally spearheaded the design process, including strategizing, user research, ideation, and creating high-fidelity mockups. User feedback was incorporated to refine the designs further.

2 Designers

1 Business analyst

1 Product Manager

Problem Statement

The client, Movement Mortgage, sought a unified portal to streamline loan officer workflow and expedite lead conversion.

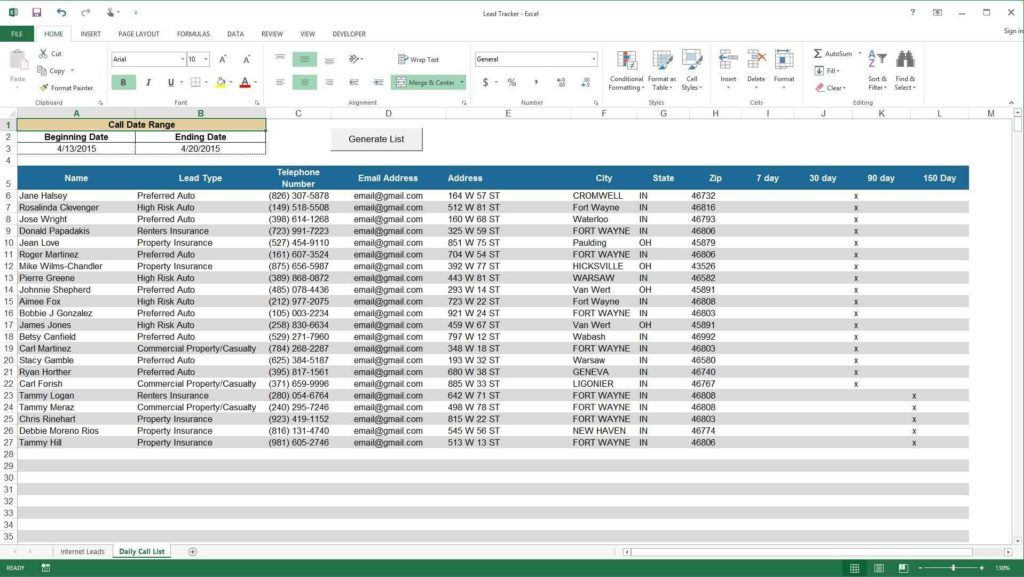

Understanding the Existing Workflow

Lead Generation:

A user survey revealed that most leads come from websites (76%). Realtors provide 18%, and the remaining 6% come through the company website and social media.

Lead Nurturing:

1) Data was primarily maintained in Excel spreadsheets.

2) Communication relied on various channels to engage leads.

3) Conversion focused on offering attractive rates and simplifying the application process.

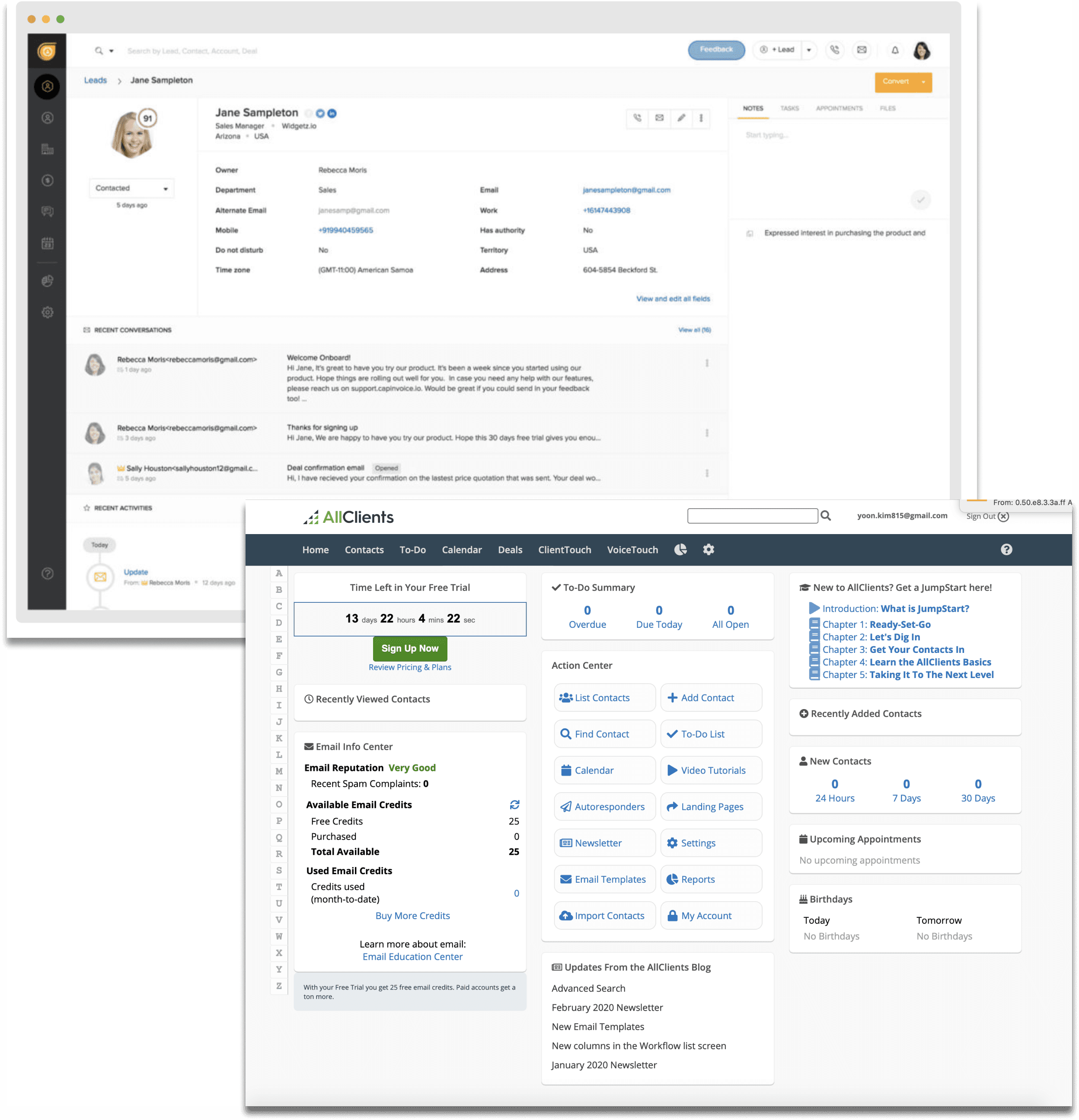

Benchmarking Against Leading CRMs

Fresh Sales:

Strengths: Integration, compliance, user experience

Weaknesses: Customization, reporting

Allclients:

Strengths: Customization, workflow automation, robust reporting

Weaknesses: User experience, compliance

Common Points:

Strengths: Intuitive interface, borrower portals, analytics

Weaknesses: Integration, customization

Common Features: All analyzed CRMs offered document management, secure storage, and communication tools specifically designed for mortgage lending.

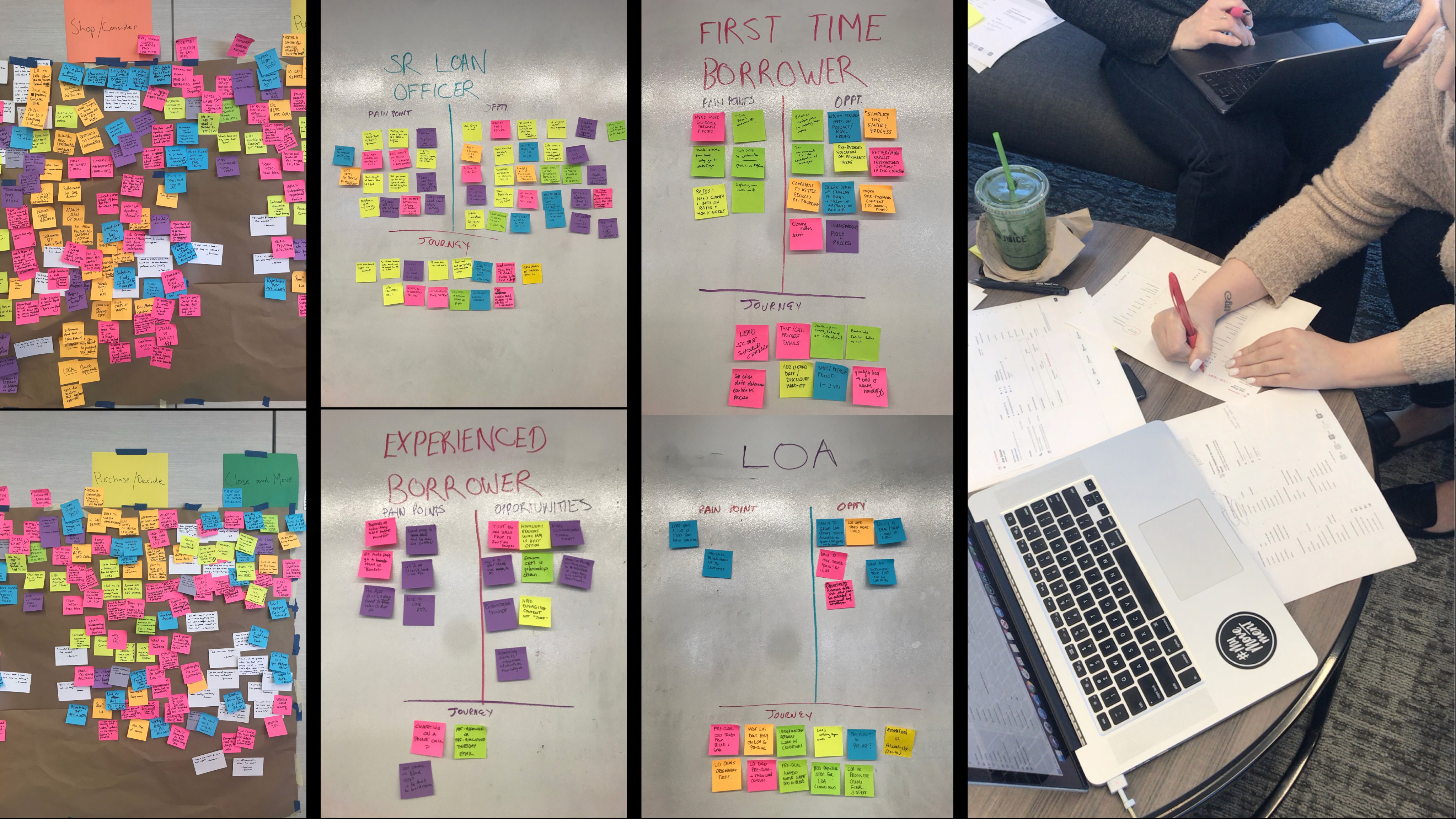

Identifying User Needs Through Workshops

1) While interest rates remained important, borrowers also valued a positive overall lender experience.

2) Consumer preference shifted towards a fully online loan process, departing from hybrid online-offline approaches.

3) Loan officers primarily relied on Excel (not a CRM) to manage leads, highlighting the need for a dedicated solution.

4) The existing system lacked features to support consistent lead outreach and lacked a loan process tracker.

5) Loan officers needed efficient lead prioritization and a centralized platform to access all related tools and resources.

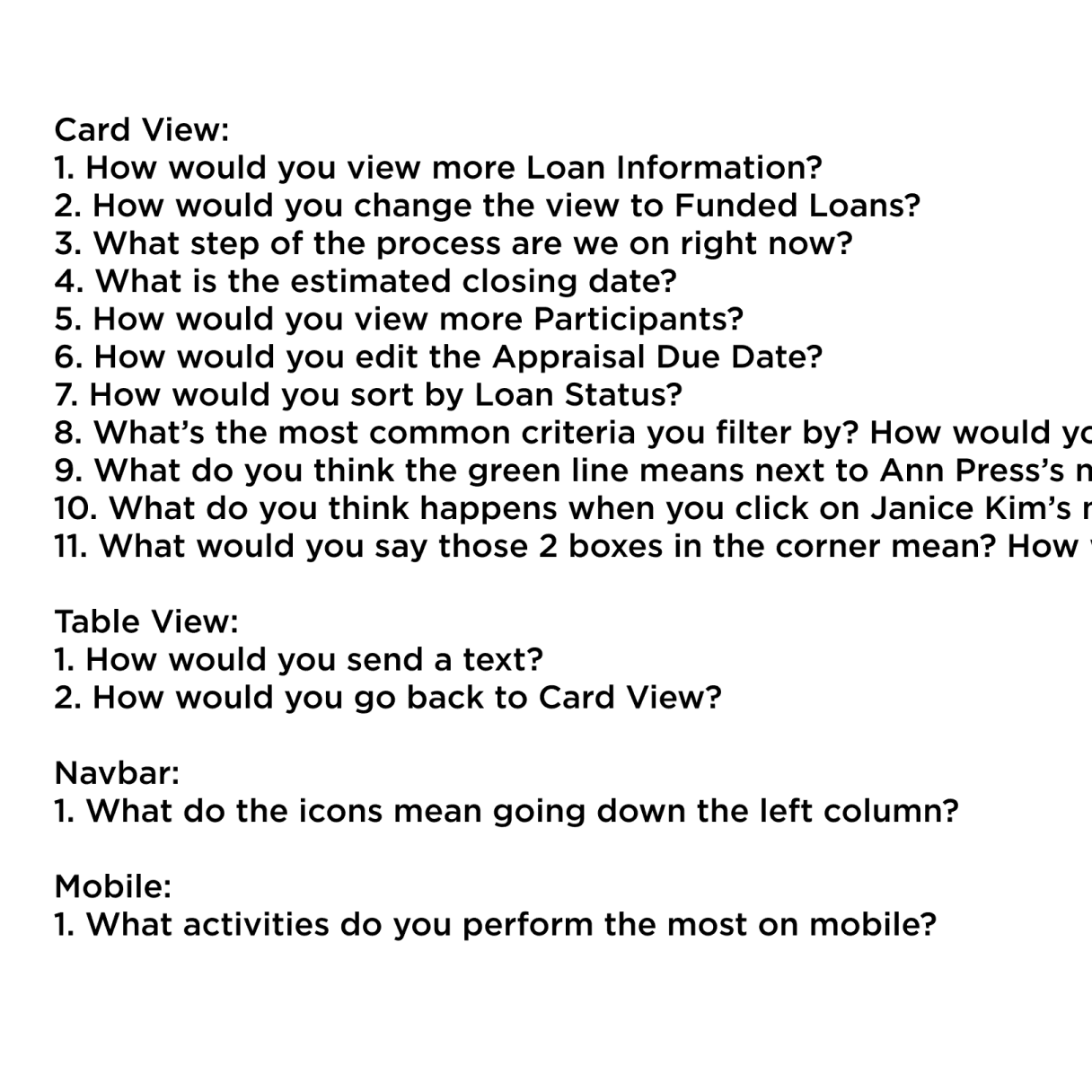

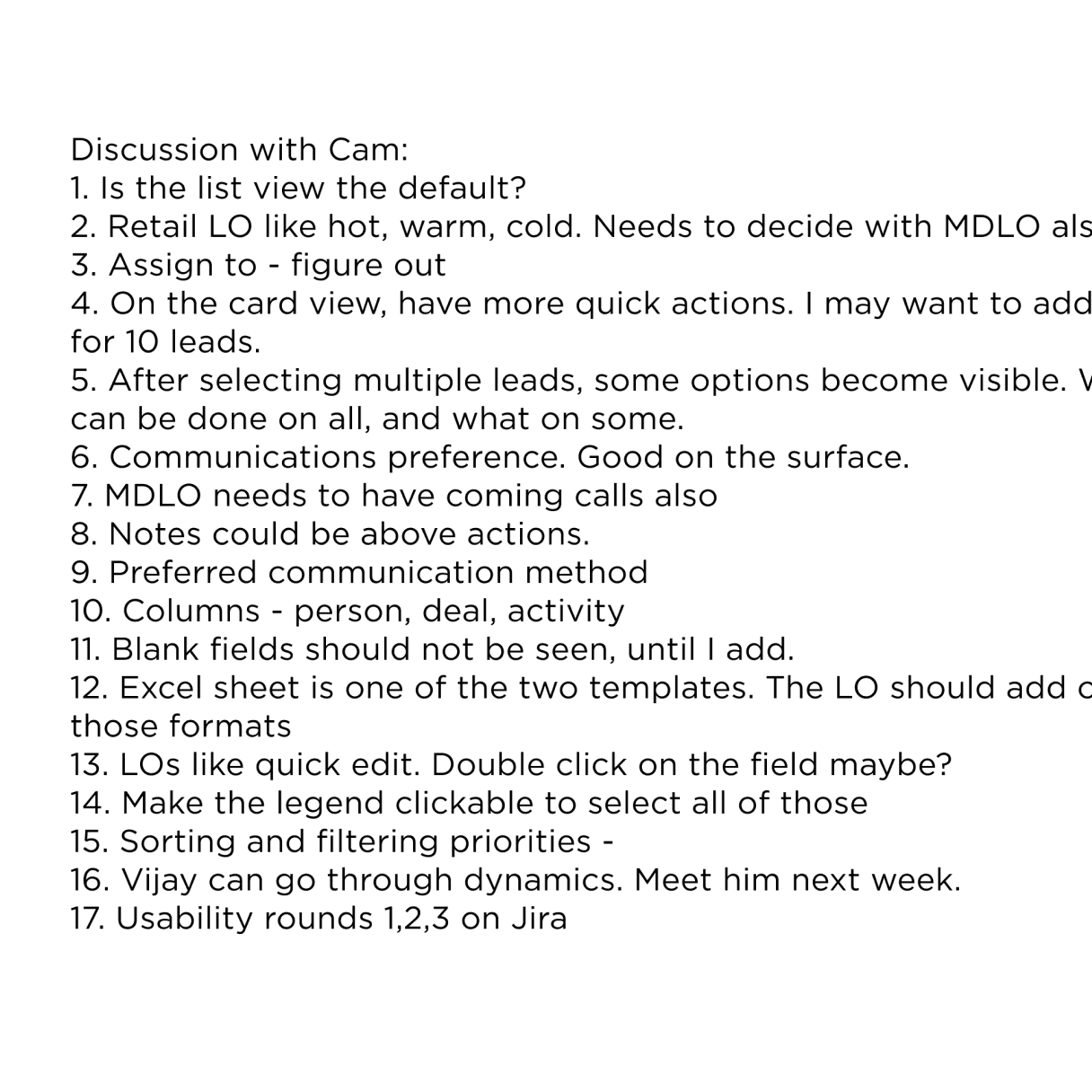

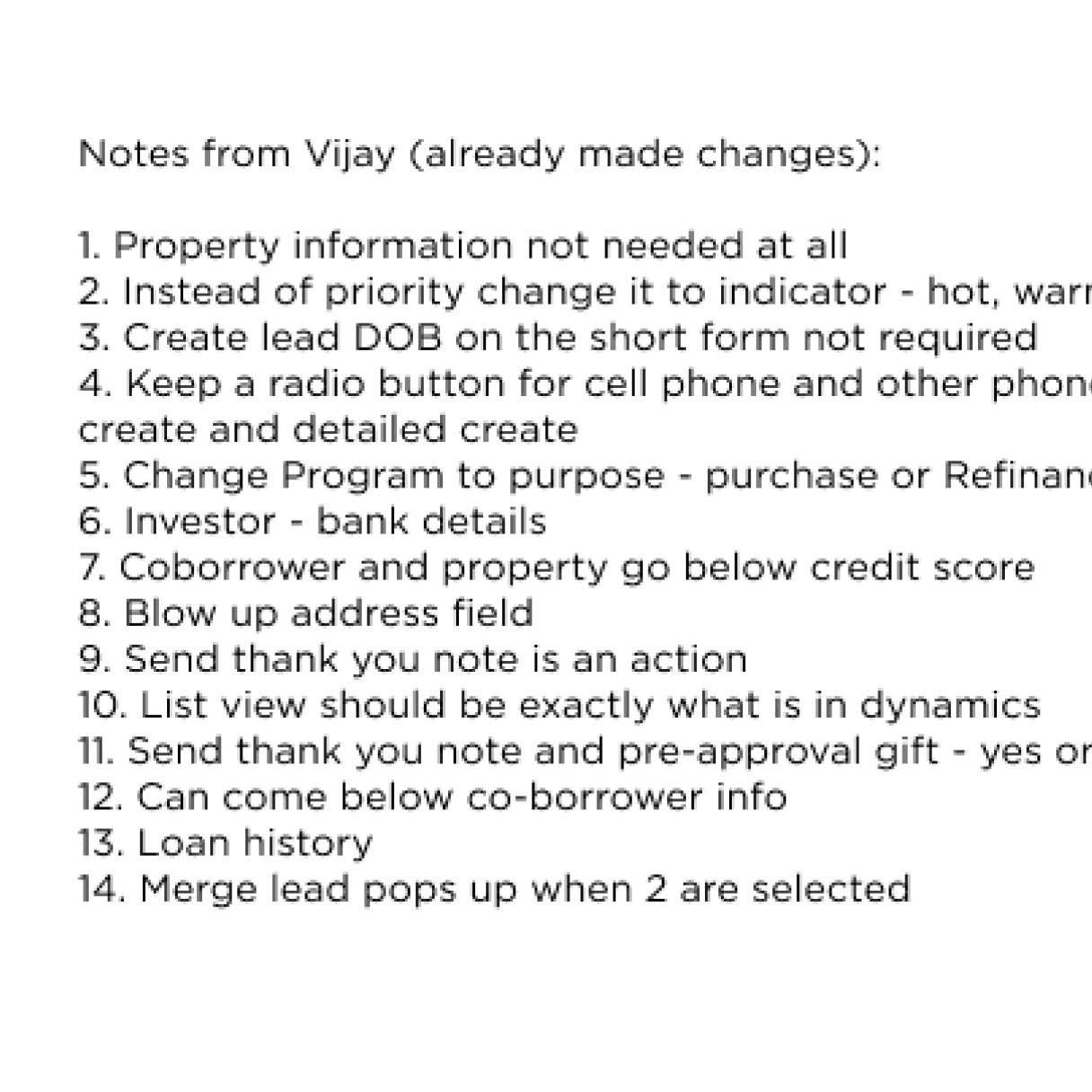

Iterative Design Based on User Feedback

Through iterative user testing and the implementation of feedback, we continuously enhanced the design, refining the visual language to deliver an optimal user experience.

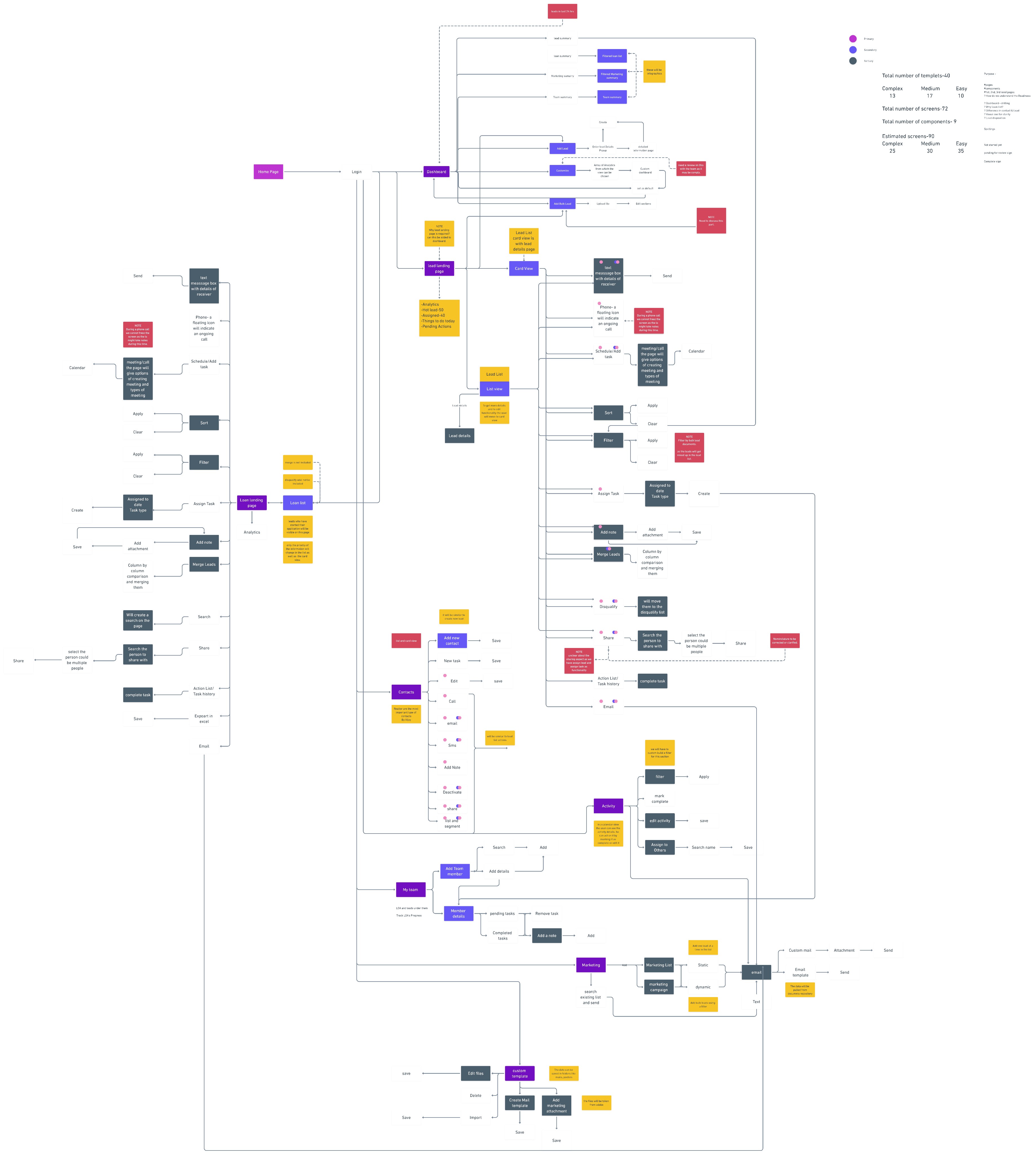

Application Structure & Scope

A Purpose-Driven Experience for Improved Conversions

This CRM application goes beyond simply storing lead data. It empowers Loan Officers (LOs) to become conversion champions. By providing a clear view of lead information and suggesting personalized actions, LOs can tailor their outreach and build stronger relationships. This fosters a nurturing environment that keeps leads engaged throughout the loan application process, ultimately leading to higher conversion rates and a smoother lending experience for everyone.

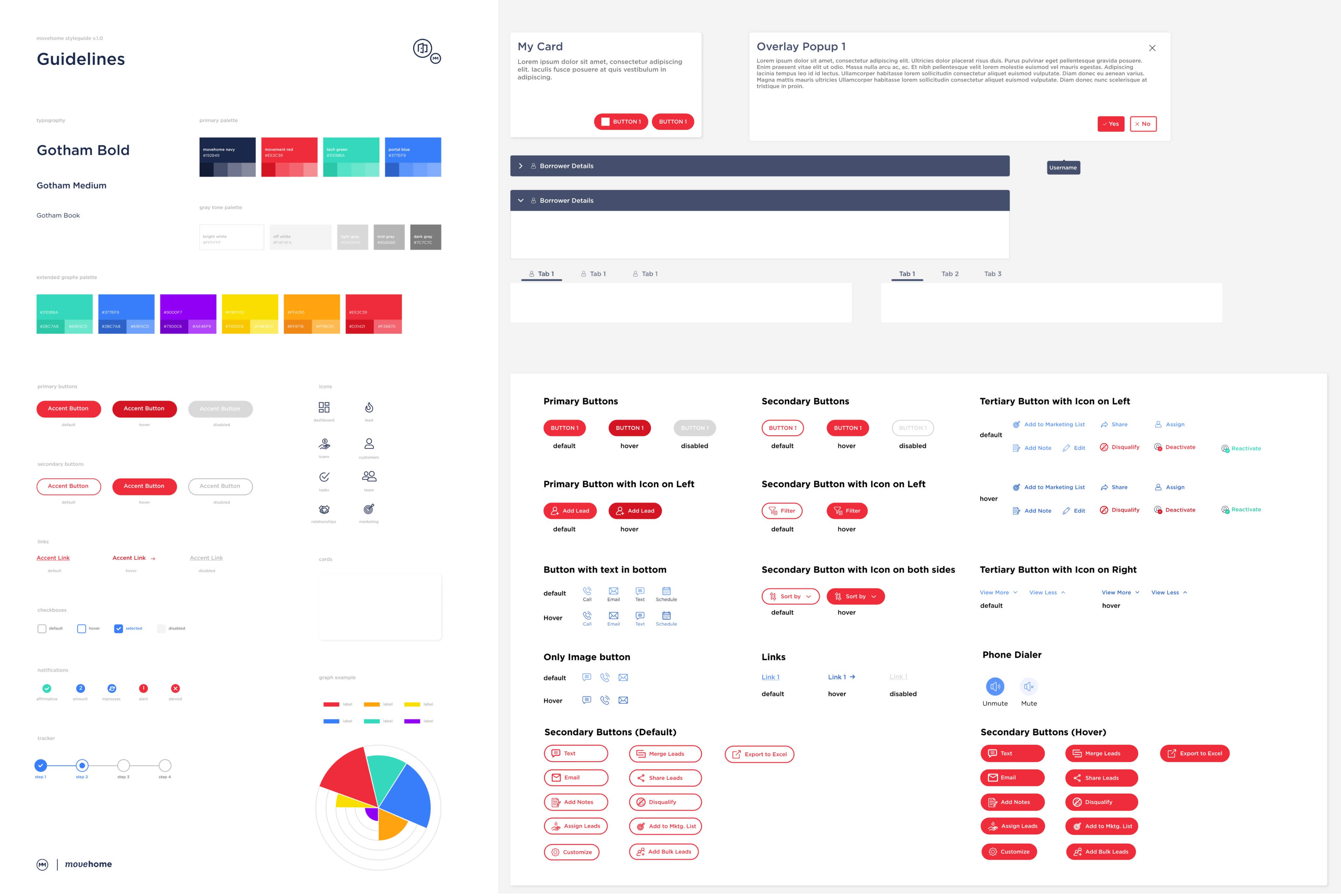

Visual Identity and Brand Guidelines

The visual language for the app was envisioned to be clean and professional, with clear navigation and data visualization tools, aiming for intuitive form designs, recognizable icons, and a responsive interface; moreover, branding elements from MM were incorporated, while stakeholder feedback was sought for refinement.

Measuring Success

The CRM launched in May 2021. Key improvements include:

1) Enhanced loan officer workflow

2) Reduced lead conversion time from 9 days to 4 days.

3) Centralized data and resource management

4) Streamlined tasks with guided processes

Snehalkumar Shinde

Digital Designer

Connect with me

snehal1155@gmail.com

+918971577976

Thank you for the visit!